##Ethereum locked in Maker hits $1 billion. But for how long?

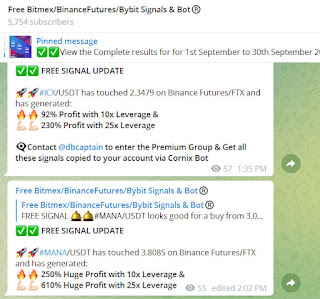

Visit - https://t.me/freebitmexsignals

For more latest news update on Cryptocurrency, Free BitMEX signals & Bitcoin BitMEX Binance auto Trading BOT visit above given Telegram group

Maker has exploded in popularity this year and as of today has $1 billion locked into its smart contracts, as the DeFi liquidity mining craze continues.

In brief

MakerDAO today hit the $1 billion of total value locked in.

It is now the third biggest DeFi token by market cap and most valuable protocol in terms of ETH locked in.

This is in part due to yield farming craze, according to crypto data provider Messari.

Decentralized finance protocol Maker today hit the $1 billion mark of total value locked (TVL) into its smart contracts.

The “value locked in” refers to the amount of money running through its smart contracts to be used for lending. Crypto data provider Messari said today that Maker is the first DeFi protocol to reach the $1 billion TVL milestone, lead in large part by the "liquidity mining" shake-up otherwise known as "yield farming."

Maker is now the third-largest DeFi token by market cap, according to data from DeFi Market Cap, and the most valuable DeFi protocol in terms of total value locked in. Compound, which launched its governance token COMP in June to much fanfare, isn’t too far behind at nearly $800 million.

The DeFi industry has continued to grow at a monumental pace. The amount of value locked into DeFi hit $4 billion at the weekend. It is now back down again at $3.6 billion, according to metrics site DeFi Pulse.

DeFi aims to revolutionize the way finance works by running borrowing and lending protocols on the Ethereum blockchain. It has grown at such a quick pace in part due to liquidity mining—or yield farming, according to Messari. This activity, which sees DeFi platforms offer token incentives in exchange for users' deposits, is seeing investors reap huge returns.

But not everyone thinks the growth is sustainable. Even Vitalik Buterin, the creator of Ethereum (the platform most DeFi projects run on) has expressed a degree of skepticism. “Decentralized finance should not be about optimizing yield,” he said in a tweet last month after the price of Compound’s COMP token went through the roof.

Some have also warned that DeFi could also be a bubble on the verge of bursting.

MKR is the governance token that dictates how MakerDAO’s decentralized stablecoin, DAI, is run. DAI, which launched in 2017, is a ERC20 token on the Ethereum blockchain pegged to the US dollar.

MKR holders are able to vote on decisions to help keep the price of DAI stable. MKR tokens are burned or created to keep the price of DAI pegged to the dollar. In addition to that, MakerDAO’s algorithms automatically manage the price of DAI, so no one person needs to be trusted to keep the currency steady.

Comments

Post a Comment