#The US is running out of coins, bringing a Digital Dollar ever closer

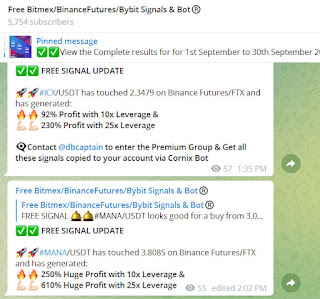

Visit - https://t.me/freebitmexsignals

For more latest news update on Cryptocurrency, Free BitMEX signals & Bitcoin BitMEX Binance auto Trading BOT visit above given Telegram group

As America runs out of coins and retailers are forced to go cashless, advocates for a Digital Dollar are seizing on the opportunity.

In brief

America is facing a severe coin shortage as a result of the coronavirus pandemic.

The US Mint has urged Americans to start spending, depositing, and exchanging their coins for currency.

Advocates of a Digital Dollar have put the case for a digital greenback to the US Senate Committee on Banking, Housing, and Urban Affairs.

One peculiar, second-hand side effect of the coronavirus pandemic has left America facing a national shortage of coins.

There are several reasons behind America's coin deficit. First, the US mint reduced the production of coins to shield businesses’ employees against the coronavirus. Secondly, no one is spending them; instead, consumers are going digital—using mobile payments, credit cards, and debit cards to avoid contact with cash. Rounding things off, retail businesses fundamental to the circulation of coins, such as laundromats, transportation, and casinos, have shuttered or slowed.

Put it all together, and you get a fairly significant coin crisis. Without the exact change to hand over to cash-paying customers, some retailers have had no choice but to stop accepting cash altogether.

To pump coins back into circulation, the Fed and the US Mint joined forces in July, rationing pennies, nickels, dimes and quarters and urging consumers to "start spending their coins, depositing them, or exchanging them for currency at financial institutions or taking them to a coin redemption kiosk."

The Digital Dollar: has the penny dropped?

With US retailers suddenly thrust into a cashless system, exposing the pitfalls of physical cash, advocates of digital currency are seizing on the opportunity.

Arguably, there has never been a better time to stop using cash. Cash use has been slowly declining—even before the coronavirus came to corrupt our coins. According to a study from the federal reserve bank of San Francisco, Americans used cash in just 26% of transactions in 2019, down from 30% in 2017.

Last week, J. Christopher Giancarlo, former chair of the Commodity Futures Trading Commission (CTFC), put the case for a Digital Dollar to the US Senate Committee on Banking, Housing, and Urban Affairs, arguing that it could "future-proof" the greenback and put it in league with similar offerings from China.

"This is what China is experimenting with today in their own currency, to make it technologically superior by making it digital, tokenizable, fractionalizable, and programmable," Giancarlo told a Senate subcommittee on economic policy in a hearing last Wednesday.

China is pressing ahead with its own digital currency, the DCEP, with a public beta ahead of a planned launch to tie in with the 2022 Beijing Winter Olympics. However, the DCEP faces questions over the privacy it affords users when making transactions; Giancarlo has previously argued that the “values of privacy that exist in a pluralist society” should also apply to central bank digital currencies (CBDCs) such as the Digital Dollar.

With cash on the decline and China forging ahead, the US faces the very real possibility of being overtaken in the race to launch a CBDC. If that doesn't incentivize the US to go digital, nothing will.

Comments

Post a Comment