#How do DeFi protocol developers make Money?

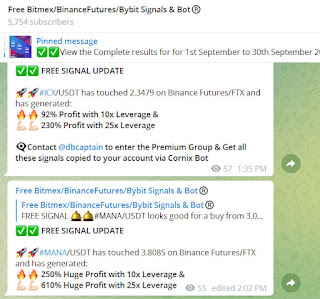

Visit - https://t.me/freebitmexsignals

For more latest news update on Cryptocurrency, Free BitMEX, Binance future, Bybit signals & BitMEX Bybit Trading BOT visit above given Telegram group

The basic principle and prerequisite of DeFi is "decentralization". As for the strength of financial attributes and the financial demand, it depends on the size and development of the entire crypto market.

DeFi can be simple. For example: there is such a contract on the chain, you can transfer 1 ETH to generate 2 DETH, and transfer these 2 DETH into it can be exchanged back to 1 ETH. The contract on the chain is a DeFi protocol. It is very simple and pure. It conforms to the basic definition of DeFi. Its financial attributes and financial needs require its developers and users interested in it to dig together.

The essence of DeFi is decentralization , which also requires DeFi to be open source. Since it is open source, it is inevitable that a homogeneous DeFi protocol will appear.

In this case, can developers charge DeFi users a handling fee?

The same smart contract runs on the chain. For users, they are indistinguishable; moreover, they are indeed indistinguishable.

If the developer team A is more well-known under the chain, and the team B that develops the same protocol (same code) is very general, but the protocol fee of B is lower; if the market data shows that the DeFi developed by team A is more popular, then the user What are you choosing? Are you choosing DeFi? Or are you choosing a development team?

If the user is choosing DeFi, the agreement developed by team A and team B is essentially the same, and there is no distinction between advantages and disadvantages; if the user is choosing a development team, then DeFi will lose its meaning, which is also different from the area. The essence of the blockchain spirit is contradictory!

After the DeFi protocol is open source, homogeneous competition will inevitably occur, which will prompt the DeFi protocol to eventually become free. Therefore, it is obviously logical that DeFi developers charge fees to DeFi users, or that they cannot be charged for a long time, and will eventually be eliminated by the market.

However, DeFi interactive tool developers can charge service fees to DeFi users.

You can make a front-end interactive tool to provide users with a DeFi interactive service with a better experience. At this time, tool developers can charge service fees to DeFi users. However, the fee is not for users to pay for using the DeFi protocol, but for paying for the interactive experience in the process of using the DeFi protocol. The protocol is indistinguishable, but the service is differentiated and can be perceived.

Why should developers develop DeFi?

There may really be developer interest, and a DeFi protocol has been developed for a certain sense of accomplishment. However, most DeFi developers should make money or meet their DeFi needs.

According to the traditional Internet thinking, if a product has no demand even by the developer itself, then it is almost impossible to be developed.

We analyze from this perspective that the original intention of developers to develop the DeFi protocol should also have the same logic: first, developers themselves have such DeFi requirements, and it is expected that such needs will also exist in the encrypted user community ; therefore, It will encourage developers to have the idea to make such a DeFi agreement, meet everyone's needs, and make money "by the way".

As for whether to make money by the way, or that the goal is to make money, we do not make a specific analysis; in short, most DeFi developers are expected to make money.

As we have analyzed before, it is impossible for DeFi developers to charge user fees. So, how can DeFi developers make money from the DeFi protocol?

Next, we analyze according to different types of DeFi protocols. There are 2 types of DeFi protocol:

The so-called non-incentive mechanism is that the protocol itself has no economic model and no token issuance. The typical case is the Uniswap protocol.

In this type of DeFi agreement, it is the liquidity provider that can make money, also known as the market maker.

If a DeFi developer wants to make money in this type of DeFi agreement, then he needs to be involved to become a member of the agreement ecosystem, for example, to be a market maker and earn what he deserves.

However, at this time, whether you are a DeFi protocol developer or other participants, you are on the same starting line, and there is no distinction between advantages and disadvantages. Perhaps the only advantage of the developer is to have a better understanding of the agreement itself, to be able to participate in it in the shortest possible time, provide services, and start to make money; after the market is balanced, the remaining advantages will no longer exist.

Therefore, in order to make money in the DeFi protocol without incentive mechanism, developers must participate as other users, otherwise there is no opportunity to make money.

Type 2: DeFi protocol with incentive mechanism

The DeFi protocol with an incentive mechanism comes with its own token economic model. Under normal circumstances, the economic model will tend to solve the problem of "cold start" of the DeFi protocol ; that is to say, the earlier the person who participates, the lower the cost of acquiring Token, and of course the risk is also greater.

At this time, for the DeFi protocol developer, he can participate in the earliest, obtain Token, participate in and promote consensus building.

Therefore, in this type of DeFi protocol with an incentive mechanism, DeFi developers have a very obvious first-mover advantage, but also meet their own needs and protocol development propositions. With the development of the agreement consensus and the application value of the agreement itself, after a period of deep development, developers will get a good return. A typical example: Satoshi Nakamoto wrote the Bitcoin protocol white paper. He also participated in Bitcoin mining in the early days, and everyone has seen what happened afterwards. Bitcoin held by Satoshi Nakamoto is already worth tens of billions of dollars.

Through the above analysis, we basically sorted out the causes and consequences of the birth of a DeFi protocol. Whether you are a DeFi protocol developer, a participant, or an ordinary user, as long as you understand the cause and effect logic clearly, you can know your rights and responsibilities in it.

The DeFi protocol is pure, objective, and reasonable; it does not have a so-called moral problem, and if it has to be said, it is also imposed on it by humans. Therefore, we should not use human defects to try to prove that DeFi is not established. This is an incompetent performance!

Comments

Post a Comment