#Why European Commission Regulations Won’t Kill Crypto in Europe

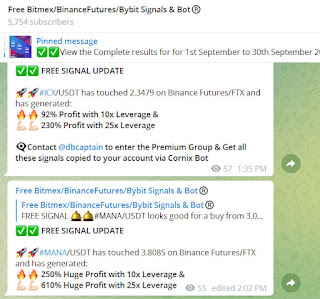

Visit - https://t.me/freebitmexsignals

For more latest news update on Crypto currency, Free Bitmex , Binance future, Bybit signals & Bitmex Bybit Trading BOT visit above given Telegram group

And if you don't like the EC's current regulatory proposals, there's time for you to do something about them.

About the author

Tom Lyons is an independent communications consultant based in Zurich. Previously an Executive Director at ConsenSys Switzerland, he currently advises the European Commission on its blockchain-related communications. The opinions expressed here are his own, and do not represent the opinions of the European Commission or Decrypt.

At the end of September, the European Commission released its new Digital Finance package, which included two sweeping regulatory proposals specific to crypto-assets and blockchain.

There is little doubt that this is a big deal. If passed, both the Regulation on Markets in Crypto Assets (MiCA) and the Pilot regime for market infrastructures based on distributed-ledger technologies (let’s call it Pilot) will set the tone for the crypto industry in Europe for a decade at least.

The good news is that the industry has been waiting for just this kind of regulatory clarity. But now that it is here, there are—perhaps predictably—voices crying foul as well. Criticisms of MiCA have run the gamut from crippling blockchain innovation to favoring incumbents to destroying all hope for DeFI in the EU.

There are certainly some potentially serious issues. But I can’t help being reminded of the outcry when the GDPR came into force. Clearly, reports back then of the death of European crypto at the hands of the EU’s data protection regime were premature. While not downplaying some of the challenges MiCA/Pilot represent to parts of the crypto industry, I think the story here is likely to be similar.

The European Commission does not want to kill crypto or blockchain in Europe.

I have been working with the European Commission’s blockchain team in various communications-related capacities for almost three years now, and have been pleasantly surprised by what seems to me its fairly progressive take on blockchain innovation and decentralization.

In terms of MiCA, as the Commission has written itself, the intention is to provide legal certainty for the crypto-assets ecosystem across Europe to make it easier for the industry to scale while still providing adequate protections. Instead of throwing all crypto-assets willy-nilly under securities regulation, as is too often the case in the US, MiCA attempts to reach this balance by a bespoke regime that regulates crypto-assets that are not financial instruments along a scale of protective measures aligned with risk. At least below certain thresholds, the Commission considers these significantly lighter-touch rules than those applying to securities.

Might the European blockchain community have a different take? Are the bars to qualify for ‘lighter touch’ perhaps set too low for the taste of many? Are there differences of opinion within the broader Commission about the risks and rewards of decentralized technologies and finance? Yes, of course. My point is that the European Commission is not out to get blockchain or crypto-assets either. It certainly sees DLT as a strategic technology (as, by the way, does the European Parliament), and it supports it with policies and funding.

The MiCA/Pilot big picture is actually going over fairly well in the community.

Over the past few days, I have spoken about these proposals with a number of industry stakeholders including INATBA, the Brussels-based international blockchain association, ADAN, the French Digital Assets Association, and the folks at XReg, the Gibraltar-based regulatory consultancy. While they have their concerns (see below), there’s a fair amount they like.

As a lex specialis for crypto-assets, MiCA signals that the European Commission considers this a new asset class that needs its own treatment. As a pan-European regulation that does not need to be transposed into law by each Member State, MiCA means harmonized rules across the whole EU (actually, the broader European Economic Area) as well as a European “passport,” opening the door to a very large market indeed for those who qualify in a single Member State.

I was also surprised by positive reactions to the Pilot proposal for a European-wide regulatory sandbox. Unlike many such sandboxes, the feeling is that Pilot could lead over time to concrete and positive changes in European regulations for security tokens. For this reason, ADAN prefers to call it not a sandbox but a "transitional regime.”

Comments

Post a Comment