#Bitcoin Price Triples in Value Against Gold Since March Crash

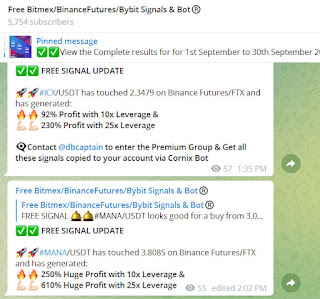

Visit - www.t.me/freebitmexsignals

Free bitMEX cross signals Binance Spot trading Bybit Coinpro Signals & bitMEX scalping trading BOT

Bitcoin’s ongoing price rally has overshadowed not only fiat currencies but gold as well.

In brief

Bitcoin's price has more than tripled against gold since the market meltdown in March.

The coronavirus pandemic and a massive influx of institutional investors gave the cryptocurrency a big push, experts said.

Bitcoin adoption might be gaining "parabolic momentum” today, they noted.

Since the coronavirus outbreak catalyzed a global market meltdown in March, Bitcoin’s price when measured against gold has not only recovered but more than tripled, according to various charting platforms such as XE.

This indicates that the “digital gold” is currently outperforming the traditional one by far. But why is this the case?

Can Bitcoin be directly compared to gold?

Speaking to Decrypt, Konstantin Anissimov, executive director of Bitcoin exchange CEX.IO, noted that it’s not entirely fair to compare the market performance of Bitcoin and gold purely in terms of their price movements. For example, Bitcoin lost 58.4% from February 19 to March 13 at its low while gold fell by only 14.6% between March 9 and March 20.

“However, if we look at the price action of both assets since the start of 2020, we will see that Bitcoin has grown by 450% and gold has only risen by 50%. Therefore, we can definitely say that Bitcoin has been a much more successful asset than gold throughout the year in terms of percentage growth,” Anissimov told Decrypt.

He added that one of the reasons behind such stark growth has been the impact of the coronavirus pandemic, especially its second wave in the autumn. Since the resurgence of global lockdowns in October, Bitcoin started to attract more and more traditional investors and high-net worth market participants as a hedge asset and means of protection against inflation, Anissimov added.

Investors are taking note. Earlier this week, Raoul Pal, CEO of financial TV channel Real Vision, decided to change his portfolio—that was split between USD, gold, and Bitcoin—and went all-in on Bitcoin and Ethereum.

“I’m a macro guy so I’m looking for where’s the best risk-adjusted return and Bitcoin was basically eating every other asset’s lunch. And I held onto my gold for as long as possible and I’m like, what is the point?” he told Decrypt, in an interview.

Institutional investors are pouring in

This sentiment was echoed by Lucas Huang, head of growth at decentralized exchange Tokenlon. He cited the increase in interest from institutional investors as one of the main factors that caused Bitcoin to fare much better than gold—especially since it has a lot of properties that are similar to the precious metal.

“Institutional investors have realized that Bitcoin has similar properties to gold, such as a limited supply. But instead of Bitcoin being new and mostly a speculative asset, it has come a long way and is seen as more established in 2020. The more 'traditional' investors buy, the more established Bitcoin gets, and that's what we are seeing right now,” he said.

Lior Messika, founder and managing partner at Eden Block, a European blockchain-focused venture fund, also highlighted the positive impact that the worldwide pandemic and global economic woes had on Bitcoin in 2020.

“Gold has long been a staple strategic asset in the allocations of institutional investors, commonly used for portfolio hedging across the board. With an American economy severely undermined by the Covid-19 health crisis, and roughly 22% of all USD ever issued printed in a single year, assets like gold, and more importantly, Bitcoin, have dramatically increased in value,

He added that while both gold and Bitcoin share the same trajectory, “Bitcoin's massive outperformance is largely due to its nascency and comparatively much lower market capitalization.”

Thus, as more investors realize that Bitcoin’s gold-like properties—such as portability, fungibility, scarcity, and divisibility—don’t depend on physicality or centralized parties, “the expansionary nature of the movement gains parabolic momentum.”

“As global belief in centralized economies continues to wane, and the need for hedging becomes more pronounced, I expect Bitcoin's price movements to resemble gold's with much higher highs and lower lows due to the asset's infancy, lower capitalization, and greater volatility,” said Messika.

He added, “All things considered, Bitcoin has never been in a better position to become a truly global market.”

Comments

Post a Comment