#The United States’ First Bitcoin Futures ETF To Debut On Tuesday

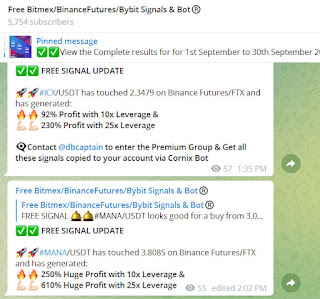

Free Crypto Signals - https://t.me/s/freebitmexsignals

For more latest news & update on Crypto currency & FREE Crypto Signals for Bitmex, Binance Futures, CoinDCX, WazirX, Coinswtich, Kraken, Bitseven & many more exchanges join above given Telegram group

ProShares‘ first Bitcoin exchange-traded fund (ETF) is scheduled to begin trading on the New York Stock Exchange (NYSE) on Tuesday.

After years of speculation and denials, the Bitcoin Strategy ETF that follows the price of Bitcoin Futures would be the first of its type to get clearance from the United States Securities and Exchange Commission (SEC). The ProShares Bitcoin ETF’s ticker symbol would be $BITO.

“2021 will be recognized for this milestone, as $BITO will provide “easy access to Bitcoin in a market-integrated wrapper,” according to Michael Sapir, Chief Executive Officer of ProShares.

*THE PROSHARES BITCOIN FUTURES ETF WILL BE LAUNCHED ON THE NEW YORK STOCK EXCHANGE ON TUESDAY: NYT

ProShares became the first company to get SEC approval, ushering in a new era. Not only have consumers and institutional investors jumped on the Bitcoin bandwagon in 2021, but many governments, like El Salvador and Paraguay, have also authorized the usage of Bitcoin in their own countries.

Concerning the Bitcoin ETF, SEC Chairman Gary Gensler has said that an ETF based on the futures market would have a greater chance of regulatory approval than one that holds Bitcoin directly. Following this announcement, many asset managers raced to apply for a Bitcoin Strategic ETF, including VanEck, ProShare, Widom Tree, and others. According to ETF experts, a spot ETF is not far behind, and the SEC may approve one in the first quarter of 2022.

The Bitcoin ETF Ushers in a New Era of Crypto Adoption

The approval of the first Bitcoin ETF in the United States opens the door to compliance and encourages investors to invest safely in digital assets. Although Europe and North America have already authorized some kind of crypto ETF, many think that US approval will fundamentally alter the future of digital assets, since the ETF market is at least seven times larger.

While many are celebrating the adoption of the first-ever Bitcoin ETF, many Bitcoin proponents think the SEC authorized a Futures ETF rather than a spot ETF on purpose to give them greater influence over the market.

Comments

Post a Comment