#How Crypto Payments Can Disrupt the Billion-Dollar Transaction Fee Industry

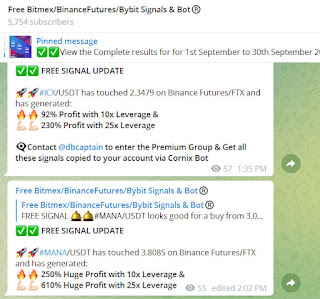

Free Crypto Signals - https://t.me/s/freebitmexsignals

For more latest news & update on Crypto currency & FREE Crypto Signals for Bitmex, Kucoin, Binance Futures, CoinDCX, WazirX, Coinswtich, Kraken, Bitseven & many more exchanges join above given Telegram group

One of cryptocurrency’s many selling points is that it offers low transaction fees and speedy processing. Where merchants might pay fees of 1.3% to 3.5% on credit card payments, a similar transaction using cryptocurrency could cost a fraction of a dollar.

The reason? Decentralization – cutting the middleman out of transactions – is where blockchain technology excels. Instead of moving through four or more intermediaries, including payment processors, assessors and banks, the payment can pass directly from the buyer to the seller.

How crypto payments could disrupt the payment processing industry

Cryptocurrencies become more mainstream with every passing day. There’s still a way to go, but an increasing number of companies now accept cryptocurrency payments – even if many do so through a third-party processor.

You can pay using crypto with companies like AT&T, PayPal and Overstock.com. You can even pay for your pumpkin spice latte using Bitcoin (BTC) at Starbucks. This year, both Amazon and Walmart have advertised digital currency positions, fueling speculation that the retail giants will soon jump on the crypto bandwagon.

Given that merchants paid $51 billion in credit card interchange fees in 2020 alone, any opportunity to reduce transaction costs is bound to catch retailers’ attention.

And retailers aren’t the only ones who want a slice of the billion-dollar transaction fee industry. There are a number of businesses ready to facilitate crypto transactions – from crypto exchanges to existing payment companies and new crypto-focused payment processors.

It’s common to see charges of around 0.5% to 1% per transaction, and some processors don’t charge any merchant fees at all. Most also have the functionality to instantly convert crypto payments into fiat (traditional) currency.

But for crypto payments to take off, the industry needs to convince consumers to join the party.

Awareness of cryptocurrency and its potential is growing. According to research by The Ascent, over 50 million Americans plan to buy crypto in the next year – and that’s on top of the 20 million or more who’ve already bought in.

Consumers who opt to pay in cryptocurrency can benefit from instant transactions and lower fees, especially on foreign transactions. Some cryptocurrency platforms also offer prepaid crypto debit cards that earn rewards on purchases, and both Mastercard and Visa have made strides with their crypto debit or credit card offerings.

The industry is still in its infancy and will also need to develop new forms of consumer protection. For example, some crypto debit cards do not carry the same levels of fraud protection as those issued by banks.

Crypto payment providers will need to find a different way to address the issue of chargebacks. These have proved costly for merchants, who can avoid them with crypto payments, but these are important for consumers as they let them claim money back from a debit or credit card provider if there’s fraud or a dispute.

In addition to developing consumer protections, the industry is likely to be impacted by increased global regulation of stablecoins and the introduction of govcoins or Central Bank Digital Currencies (CBDCs).

Will we all pay with crypto one day

While crypto payments are exciting, this is still a relatively new industry and there’s plenty of room for development, both in terms of the technology itself and people’s understanding of it.

One reason crypto hasn’t yet turned the payment processing industry on its head is that prices are still volatile. The price of Bitcoin can easily gain or lose 20% of its value in a week. For merchants who need to use their crypto cash to meet real-world obligations, this can play havoc with their cash flow.

Another is that many Americans view cryptocurrency as an investment. They hope that it will appreciate in value and so are reluctant to spend it on their day-to-day expenses. It would be a bit like trying to use a fraction of an Amazon stock to pay for your weekly groceries.

According to crypto payment processor BitPay, Bitcoin is still the most used cryptocurrency, accounting for 60% of payments in September. Ethereum (ETH) and Bitcoin Cash (BCH) are in second and third place with just over 10% each. And Litecoin (LTC) recently launched its own visa debit card that maintains users’ balances in LTC.

It will be interesting to see how the crypto payment industry evolves. Right now, many of the US retailers that accept crypt

o have opted to do so through third parties – but in the future, they might take crypto payments directly from consumers.

Comments

Post a Comment