#Arbitrum Transaction Volume Spikes With Increased DeFi Activities

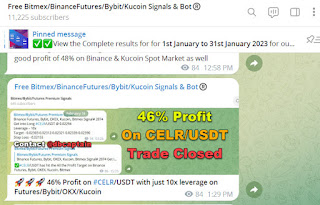

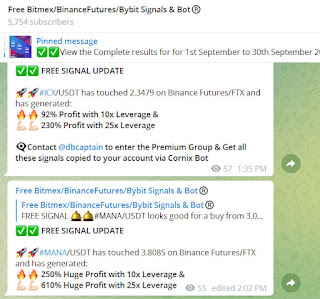

Visit - https://telegram.me/freebitmexsignals

(#95% Profit on #DGB/USDT) (#50% Profit on #HIGH/USDT) (#93% Profit on #INJ/USDT) (#57% Profit on #SPELL/USDT) (#50% Profit on #KSM/USDT) (#46% Profit on #CELR/USDT) (#50% Profit on #BTC/USDT) (#128% Profit on #AUDIO/USDT) (#95% Profit on #SKL/USDT) (#45% Profit on #GALA/USDT) - ALL FREE & Paid signals share in our Telegram group went in good profit. We are Largest Crypto Signals services on Telegram in 2023 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

In Brief

Arbitrum's daily transaction has hit a new high of 690,000.

The network's decentralized exchange trading volume has also beaten that of Binance Smart Chain.

The layer2 network stablecoin inflow has also risen to new highs during the period.

According to on-chain data, daily transactions on Ethereum’s layer2 (L2) network Arbitrum touched a new all-time high of 690,000 on Feb. 17.

However, its record is still behind its rival L2 network, Optimism. Optimism’s daily transactions touched an all-time high of over 800,000 in early January when it incentivized its users with an NFT Quest program.

L2Beat data shows that transactions on Arbitrum’s chain Nova and One rose 168.81% and 67.88% in the last seven days.

Arbitrum’s DeFi Activities Rise

The total value of assets (TVL) locked on Arbitrum has risen to $3.27 billion as of press time, according to L2Beat data. DeFillama data shows that the TVL stands at $1.8 billion

Per DeFillama, derivatives platform GMX dominates the network with a TVL of $522.76 million. Zyberswap and Uniswap follow it.

Meanwhile, Wu Blockchain reported that Arbitrum witnessed a steady inflow of stablecoins in February. According to the reporter, USDC’s inflow grew by 31% while that of USDT and DAI increased by 45% and 68%, respectively.

Cumulatively, the total Arbitrum stablecoin market cap sits at $1.26 billion, with USDC accounting for 66% of it, according to DeFillama data.

DEX Trading Volume Beat Binance Smart Chain

Meanwhile, decentralized exchange (DEX) trading volume on the L2 network has grown over the past week by over 22% to the second-largest, according to DeFillama data.

Arbitrum’s DEX trading volume beat storied rivals like Binance Smart Chain (BSC), Polygon, and others in the last 24 hours. Per the data, Arbitrum recorded $307.26 million, above BSC’s $272.71 million and Polygon’s $159.15 million.

However, its volume is miles behind that recorded on Ethereum mainnet, which stands at $1.14 billion.

In the last 24 hours, the dominant DEX on Arbitrum is Uniswap with $132.19 million, followed by SushiSwap with $81.78 million.

Gas Usage Spikes

Arbitrum’s gas usage has also increased following the increased network activities.

According to Dune analytics data, the L2 has seen massive spikes in its gas consumption rate compared to other networks.

The increased gas consumption rate has coincided with the growing number of active wallets on Arbitrum. Dune analytics data shows that it currently has 2.8 million full addresses, with 2.2 million making at least one transaction.

Comments

Post a Comment