#Cathie Wood’s Ark Invest Has Bought Almost $20M in Coinbase Stock Since January

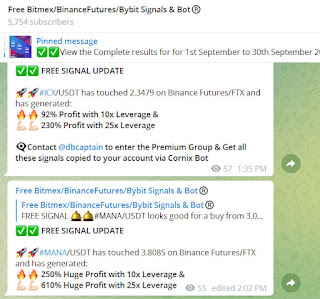

Visit - https://telegram.me/freebitmexsignals

#40% Profit on #HIGH/USDT) (#88% Profit on #ZEN/USDT) (#54% Profit on #GMT/USDT) (#32% Profit on #ROSE/USDT) (108% Profit on #MINA/USDT) (#50% Profit on #AUDIO/USDT) (#50% Profit on #ROSE/USDT) (#38% Profit on #T/USDT) (#25% Profit on #ANKR/USDT) - ALL FREE & Paid signals share in our Telegram group went in huge profit. We are Largest Crypto Signals services on Telegram in 2022 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

Six weeks into 2023, long-time Bitcoin bull Cathie Wood continues to relentlessly load up on Coinbase stock.

Ark Invest, the investment house led by Cathie Wood, bought another 162,325 shares in crypto exchange Coinbase (COIN) last Friday, according to an investor email seen by Decrypt.

The latest purchase, worth $9.26 million and split across the ARK Innovation ETF (ARKK) and the ARK Next Generation Internet ETF (ARKW)—139,105 and 23,220 shares, respectively—brings Ark’s total investment in COIN to approximately $19.73 million since the start of the year.

This follows a series of purchases made between January 5 and January 11, when Ark Invest bought a total of $10.47 million worth of Coinbase stock.

The most notable purchase occurred on January 5 when Ark scooped up a total of 172,276 shares of Coinbase, worth $5.77 million, followed by a January 11 purchase of 74,792 COIN worth $3.275 million.

ARKK’s banner month

The vast majority of Coinbase shares purchased by Ark this year were added to ARKK, the firm’s flagship fund that seeks long-term capital growth from companies involved with, or that benefit from, disruptive innovation. COIN’s weight in ARKK currently stands at 4.62%, according to the company.

ARKW, which actively invests in internet-based products and services, cloud computing, artificial intelligence, e-commerce, and media innovations, as well as the ARKF fund focusing on fintech companies with long-term growth potential, have been the two other recipients of Coinbase stock this year.

COIN peaked at $81.6 this year at the beginning of February amid the strong January performance for crypto markets; however it fell almost 22% last week to $57.09 at Friday’s close bell.

January was also a banner month for ARKK, with the fund’s shares soaring 28% from the end of December, marking its best monthly performance since 2014.

The February downturn in crypto markets, which took the price of Bitcoin down 9.5% over the past two weeks, appears to have taken its toll on Ark’s leading investment product too, with ARKK’s price falling to $39.17 on Friday from $44.41 at the beginning of the month.

The overall drop in ARKK’s price was partly softened by its soaring Tesla stock holdings; the electric car manufacturer's shares, which account for 10.58% of the fund, rallyed over 60% in the past month.

Crypto exchanges have found themselves in the regulatory spotlight over their staking services, after Kraken was slapped with a $30 million fine by the SEC for offering unregistered staking services in the U.S. With Coinbase CEO Brian Armstrong stating that the crypto exchange is prepared to go to court to defend its own staking offering, Wood has also weighed in on the SEC's actions.

"So, activity moves to offshore exchanges or to self custody, self sovereignty, and self control? Decentralization wins," Wood said, responding to a tweet from Ark Invest director of research Frank Downing, who compared the SEC action against Kraken to China’s 2021 ban on Bitcoin mining. "Given regulatory arbitrage, however, US exchanges lose to foreign exchanges," Wood added–something she deemed, "not so good for US competitiveness in the crypto revolutions."

Comments

Post a Comment