#Tesla Details $140 Million Bitcoin Loss in SEC Filing

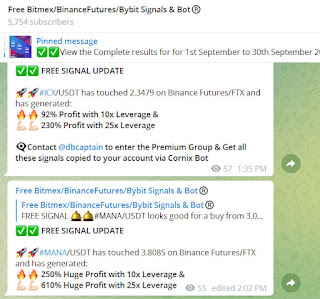

Visit - https://telegram.me/freebitmexsignals

(#56% Profit on #MASK/USDT) (#50% Profit on ##FIL/USDT) (#30% Profit on #ALICE/USDT) (#50% Profit on #BLZ/USDT) (170% Profit on #IMX/USDT) (#31% Profit on #KLAY/USDT) (#210% Profit on #ETH/USDT) (#150% Profit on #MANA/USDT) - ALL FREE & Paid signals share in our Telegram group went in huge profit. We are Largest Crypto Signals services on Telegram in 2022 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

The electric car company saw its Bitcoin losses double since 2021

Tesla lost over $140 million betting on Bitcoin last year, according to a Monday filing with the U.S. Securities and Exchange Commission. The electric car manufacturer took a $204 million impairment charge while gaining $64 million through converting Bitcoin in 2022.

“In the year ended December 31, 2022, we recorded $204 million of impairment losses resulting from changes to the carrying value of our Bitcoin and gains of $64 million on certain conversions of bitcoin into fiat currency by us,” Tesla said in the filing.

An impairment charge describes a reduction or loss in the value of an asset. It can occur because of a change in economic circumstances, like the crypto winter that gripped the market after the collapse of Terra Luna in May 2022.

The annual disclosure to the SEC comes less than a week after Tesla’s quarterly earnings report, which included no Bitcoin transactions but nonetheless saw the value of its holdings decline, generating a $43 million loss for the last four months of 2022.

In February 2021, Tesla invested a staggering $1.5 billion in Bitcoin, making it one of the largest corporate holders of the cryptocurrency—second only to MicroStrategy. At the time, Bitcoin traded at $46,364 per coin. By November 10, 2021, Bitcoin saw its all-time high of $69,044 per coin, according to CoinGecko.

But the good times did not last as Bitcoin, and the rest of the cryptocurrency market, went into freefall in 2022. As of January 31, 2023, Bitcoin is trading at around $23,051.

Tesla’s impairment losses nearly doubled since 2021 when, in an SEC filing that year, Tesla reported a $101 million impairment loss on digital assets and $128 million gains after selling Bitcoin in 2021.

By October 2022, Tesla reported to investors that the company still held over $218 million in Bitcoin after selling 75% of its holdings in July—around $936 million at the time.

“As with any investment and consistent with how we manage fiat-based cash and cash-equivalent accounts, we may increase or decrease our holdings of digital assets at any time based on the needs of the business and our view of market and environmental conditions,” the company said in Monday’s filing.

In the filing, Tesla calls its Bitcoin holdings indefinite-lived intangible assets. These assets are periodically reviewed to determine if their value on the balance sheet exceeds their fair market value. As Tesla explained, these impairment charges may affect the company’s further investment in Bitcoin.

For any digital assets held now or in the future, these charges may negatively impact our profitability in the periods in which such impairments occur even if the overall market values of these assets increase,” the company said.

Neither the quarterly earnings report nor the SEC filing identified any specific digital assets besides Bitcoin. The company is believed to hold Dogecoin, however, as it accepts the meme-coin as payment, and CEO Elon Musk is a self-avowed fan.

Comments

Post a Comment