##Binance leads Voyager asset race but lender may face $60B fines

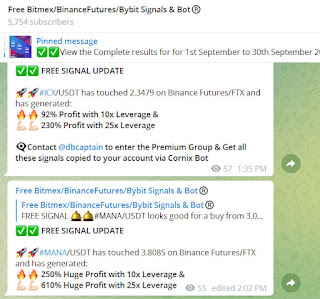

Visit - https://telegram.me/freebitmexsignals

(#150% Profit on #STG/USDT) (#138% Profit on #ZRX/USDT) (#40% Profit on #ETH/USDT) (#33% Profit on #GMT/USDT) (#17% Profit on #BAND/USDT) (#37% Profit on #AGIX/USDT) (#25% Profit on #BCH/USDT) (#50% Profit on #XEM/USDT) - ALL FREE & Paid signals share in our Telegram group went in good profit. We are Largest Crypto Signals services on Telegram in 2023 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

In July 2022, Voyager Digital filed for Chapter 11 bankruptcy, and for more than seven months, its customers have been fighting to get their money back. Soon, Binance could emerge as the winning suitor.

Recently, Voyager Digital users voted in favor of a bankruptcy plan that would see Binance as the acquirer of approximately $1 billion worth of customer assets. Voyager Digital claims 97% of voting customers approved the plan.

The deal could be finalized as early as April 18 and if it closes, Voyager Digital’s customer assets will be transferred to Binance. They will then be able to sign into Binance and withdraw.

Binance, of course, hopes that a meaningful percentage of those customers will decide to stay and trade on its platform. It views the Voyager Digital acquisition as a cost of acquiring a large cohort of customers.

Leticia Sanchez, a director of bankruptcy management firm Stretto, filed the voting results with the United States Bankruptcy Court for the Southern District of New York.

Meanwhile, regulators in a dozen states have decided not to pursue civil claims until Voyager Digital’s customers receive payment. Regulators say Voyager Digital may owe nearly $61 billion in fines for offering unregistered securities to its constituents.

FTX now obviously out of the question

Voyager Digital had been searching for a buyer for its assets since it filed for bankruptcy in July. FTX previously entered a bid to acquire its assets, however, that deal fell through when FTX and Alameda Research spectacularly nosedived into bankruptcy in November.

After FTX and Alameda filed for bankruptcy, Alameda attempted to claw back up to $446 million in loan payments that it had made to Voyager Digital. Predictably, Voyager Digital shareholders objected to that move, saying it could leave them open to a $75 million unsecured claim.

Some wanted Sam Bankman-Fried (SBF) to testify. Many wanted an explanation as to how he could want hundreds of millions of dollars back from Voyager’s customers after stealing billions of dollars from FTX customers. SBF’s lawyers, however, objected to a subpoena to testify in the Voyager Digital bankruptcy case, saying that he’s facing enough fraud charges related to the FTX and Alameda Research bankruptcies. Indeed, SBF faces life in prison and total bankruptcy, depending on the outcome of his existing civil and criminal lawsuits.

Binance to Voyager Digital’s rescue

After the FTX acquisition deal fell through, Voyager Digital worked out another deal with Binance.US and its parent conglomerate,

Binance. As of August 19, 2021, Binance CEO Changpeng Zhao owned 90% of the Binance.US equity.

The SEC, FTC, and a financial regulator in New York quickly filed objections and regulators alleged that Binance.US failed to demonstrate how it would protect customer assets.

The regulators also noted how the deal might have improperly released Voyager Digital executives from pending fraud claims.

Furthermore, New York says Binance is not authorized to operate in the state. In the opinion of the state’s financial regulator, Binance.US’ acquisition could harm Voyager Digital customers who reside in New York. The deal would force New York residents to liquidate crypto holdings on the platform.

In addition, the Texas State Securities Board and Texas Department of Banking filed their own objections. They say Binance.US failed to file adequate disclosures about the terms of the acquisition. The Texan regulators also say Binance.US failed to show that the company operates legitimately and independently of Binance, the parent company.

In any case, Voyager Digital customers have voted to move forward with a proposed bankruptcy plan for Voyager in favor of Binance’s offer. Bankruptcy manager Stretto has filed the voting results with a bankruptcy court in New York. Customers await further proceedings in the court and the finalization of any terms prior to the tentative closing date of April 18.

Comments

Post a Comment