##Crypto Giant DCG Revealed a Loss of Over $1 Billion in 2022

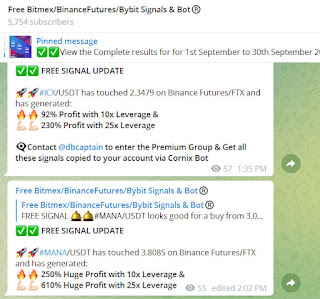

Visit - https://telegram.me/freebitmexsignals

(#40% Profit on #BTC/USDT) (#50% Profit on #XEM/USDT) (#61% Profit on #IMX/USDT) (#40% Profit on #MATIC/USDT) (#50% Profit on #NEO/USDT) (#33% Profit on #ACH/USDT) (#30% Profit on #BNB/USDT)- ALL FREE & Paid signals share in our Telegram group went in good profit. We are Largest Crypto Signals services on Telegram in 2023 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

DCG reported a financial loss of $1.1 billion in 2022 due to the crypto market crash and Genesis’ bankruptcy.

The venture capital firm focused on cryptocurrencies – Digital Currency Group (DCG) – reportedly marked a loss of $1.1 billion last year.

Some of the primary reasons for the downfall were the collapse of the crypto market and the bankruptcy of its subsidiary – Genesis.

DCG – a crypto conglomerate shuttered by scandals and the bear market – disclosed in a report (seen by CoinDesk) that the turbulent 2022 resulted in a $1.1 billion loss for the company.

It pointed out Genesis’ demise (a cryptocurrency lender under its umbrella) and the decline of bitcoin as the main factors behind the losses:

“In addition to the negative impact of [bitcoin] and crypto asset price declines, last year’s results reflect the impact of the

Three Arrows Capital (TAC) default upon Genesis.”

It is worth mentioning that Genesis was not the only DCG subsidiary that experienced some issues. The London-based digital asset platform Luno recently dismissed 35% of its employees, citing “the incredibly tough year for the broader tech industry and the crypto market.”

DCG finished Q4 2022 with a loss of $24 million, while the revenue was $143 million. Consolidated revenue for the entire year reached $719 million.

As of the end of December 2022, DCG held total assets of $5.3 billion, only $262 million of which were cash and cash equivalents.

The company’s equity valuation hit $2.2 billion, while shares traded at nearly $28. “This appraisal is generally consistent with the sector’s 75%-85% decline in equity values over the same period,” it stated in the report.

Contrary to the monetary loss, DCG restructured its $1.1 billion promissory note (due in 2032) and vowed to issue a new type of redeemable, convertible preferred stocks.

Comments

Post a Comment