##Institutional Investors Move Money Out of Crypto Markets for Fourth Straight Week: CoinShares

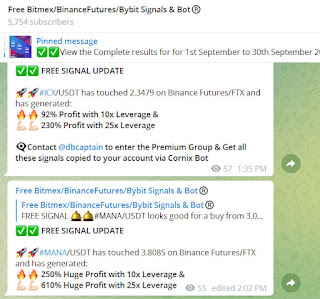

Visit - https://telegram.me/freebitmexsignals

(#40% Profit on #IMX/USDT) (#50% Profit on #MANA/USDT) (#40% Profit on #YFI/USDT) (#30% Profit on #LTC/USDT) (#50% Profit on #BAT/USDT) (#115% Profit on #SNX/USDT) (#50% Profit on #IMX/USDT) (#78% Profit on #SSV/USDT) (43% Profit on #HOOK/USDT)- ALL FREE & Paid signals share in our Telegram group went in good profit. We are Largest Crypto Signals services on Telegram in 2023 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

Digital assets manager CoinShares says institutional crypto investment products suffered their fourth consecutive week of outflows last week.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto investment products suffered outflows of nearly $20 million last week, along with minor inflows into short investment products.

“Digital asset investment products saw minor outflows totaling US$17m last week, marking the 4th consecutive week of negative sentiment.”

Bitcoin (BTC) products took the heaviest hit of outflows at $20.1 million. Meanwhile, short-Bitcoin products saw minor inflows of $1.8 million. Short-BTC products have enjoyed the second highest year-to-date inflows, about $50 million to Bitcoin’s $126 million.

Coinshares says it believes regulatory uncertainty may be the cause of investors rushing to short-BTC products.

“Despite the recent inflows into short-bitcoin, total assets under management (AuM) have risen by only 4.2% YTD [year-to-date] compared to long-bitcoin AuM having risen by 36%, suggesting short positions have not delivered the returns some investors expected this year so far. Nonetheless, it likely represents continued investor concerns over regulatory uncertainty for the asset class.”

Most altcoin investment products enjoyed minor inflows last week. Multi-asset investment vehicles, those investing in a basket of digital assets, raked in $0.8 million in inflows last week. Ethereum (ETH) products took in $0.7 million, while Solana (SOL) vehicles took in $0.3 million. Binance (BNB) and Cosmos (ATOM) products both suffered minor inflows, $0.4 million and $0.2 million, respectively

Comments

Post a Comment