#The Great Investment Debate: Bitcoin, Gold, Real Estate, or Stocks?

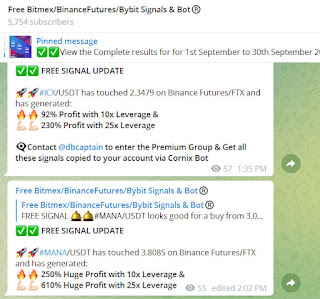

Visit – https://telegram.me/freebitmexsignals

(#25% Profit on #CRV/USDT) (#40% Profit on #XMR/USDT) (#65% Profit on #REN/USDT) (#50% Profit on #MASK/USDT) (#40% Profit on #BTC/USDT) (#40% Profit on #CRV/USDT) (#21% Profit on #ENJ/USDT) (#66% Profit on #CFX/USDT) ALL FREE & Paid signals share in our Telegram group went in good profit. We are Largest Crypto Signals services on Telegram in 2023 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

In Brief

Not all asset classes are created equal.

15 years ago there was no cryptocurrency as an asset.

Today, which asset class outperforms: cryptocurrency, gold, real estate, or stocks?

As finance is now globalized, the debate of which investment provides the most significant return rages on. Investors worldwide grapple with the question: Bitcoin, Gold, Real Estate, or Stocks? Let’s explore each investment type’s historical performance and future potential, beginning with Bitcoin.

Bitcoin

Many investors consider Bitcoin a revolutionary investment, some even referring to it as “digital gold.” While it has been volatile over the years, Bitcoin (BTC) has seen tremendous growth since its inception in 2009. BTC value has surged to an all-time high of nearly $65,000 in April 2021. However, since then, the price has fallen more than 70% from its ATH, raising questions about its future potential.

Despite the recent slump, investors like Michael Saylor of MicroStrategy remain ultra-bullish on Bitcoin. Saylor arguing BTC is the best investment due to its scarcity and utility. However, not everyone is convinced, and Saylor has faced criticism for investing so much of his company’s money into Bitcoin.

Gold

Gold has been a reliable investment prized for its value and stability for centuries. It has stood the test of time and remains a popular investment option for those looking for a safe haven during uncertain times. Gold has seen significant growth over the years, with its value increasing nearly fivefold over the past two decades.

However, not everyone is convinced. “Gold bugs” like Peter Schiff argue that gold is the only true safe haven investment, dismissing Bitcoin as a speculative asset. Meanwhile, others like Michael Saylor and Max Keiser believe that Bitcoin will eventually replace gold as the go-to safe haven investment due to its limited supply and superior technological capabilities.

Real Estate

Real estate has long been a popular investment option. Many investors see it as a way to generate passive income and build wealth over time. While it has seen its ups and downs over the years, real estate has been a reliable investment. Historically real estate value has been steadily increasing over time.

Yet, real estate can be risky because it is dependent on economic conditions and local market comparisons. The recent pandemic has highlighted the risks of real estate investing, with many commercial properties facing significant challenges due to the shift to remote work.

Stocks

Finally, stocks have been a go-to investment for many, with the potential for significant growth and return over time. With the rise of technology, investing in stocks has become more accessible to retail investors, with many platforms offering commission-free trading.

While stocks have seen significant growth over the years, they can be highly volatile, with sudden market crashes causing significant losses for investors. Moreover, not all stocks are created equal, with some companies experiencing significant growth while others struggle to stay afloat.

Over the years, there has been a growing interest in the relationship between Bitcoin and traditional investments like the stock market. While some investors view Bitcoin as an alternative asset, others see it as a complement to their existing investment portfolio.

Let’s take a closer look at how Bitcoin has performed, on average, against the stock market, particularly the S&P 500 and NASDAQ.

Bitcoin vs. Stocks

Historically, Bitcoin has been uncorrelated with the stock market. However, in recent years, there has been a growing correlation between Bitcoin and the stock market, particularly during times of economic uncertainty. And yes, we are in uncertain times now.

When the stock market experiences significant losses, investors may turn to alternative assets like Bitcoin as a hedge against inflation and market volatility. This was evident during the COVID-19 pandemic, where Bitcoin saw significant growth as the stock market experienced significant declines.

Bitcoin vs. S&P 500

The S&P 500 is considered one of the most accurate measures of the stock market’s performance, representing the top 500 publicly traded companies in the United States. Historically, Bitcoin and the S&P 500 have been uncorrelated, but there has been a growing correlation between the two in recent years.

Bitcoin and NASDAQ

The NASDAQ is an index that tracks the performance of over 3,000 technology companies, including some of the world’s most significant technology giants like Apple, Amazon, and Google. Historically, Bitcoin has been more correlated with the NASDAQ than with the S&P 500.

In a similar study, Bloomberg showed the bond between Bitcoin and the NASDAQ was 0.51 over the past year, indicating a moderately positive relationship between the two. This is likely due to Bitcoin’s status as a digital asset that relies heavily on technology and its growing adoption by technology companies.

Comments

Post a Comment