##Bitcoin Remains the Sole Focus for Investors With $104M Weekly Inflows: Report

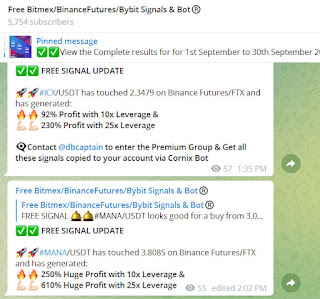

Visit – https://telegram.me/freebitmexsignals

(#23% Profit on #NEAR/USDT) (#40% Profit on #MINA/USDT) (#290%) Profit on #CELR/USDT) (#62%) Profit on #SNX/USDT) (#125%) Profit on #WOO/USDT) (#222%) Profit on #HOOK/USDT) (#33%) Profit on #ADA/USDT) (#33%) Profit on #BEL/USDT) (#200) Profit on #ID/USDT) (34% Profit on #ETH/USDT) – Our premium Bitmex, Bybit, and Binance futures auto Trade Copier cum BOT copies all signals to your account using the cornix Bot. In 2023, our crypto signals service will be the biggest on Telegram. Our Trade Copier's superior AI and integrated approach for maximum gains have allowed it to consistently trade in the right direction over the previous few months. It stands out since the BOT copies all signals, eliminating the need for human interaction and only producing a big profit.

Altcoin speculation item have showed almost no movement.

Bitcoin has proceeded with its bullish streak as advanced resource the executives item inflows hit $114 million last week. The more extensive resource class has recorded a 4-week run of inflows currently adding up to $345 million, as indicated by the most recent information shared by CoinShares report.

All the while, the market has completely remedied the past 6-week run of surges that added up to $408 million.

Bitcoin in the Bleeding edge

The sole focal point of financial backers was on Bitcoin, as confirmed by its inflows of $104 million. The superior feeling was joined by low market volume. CoinShares refered to "a trip to somewhere safe" by financial backers unfortunate of the present status of conventional money.

In any case, conclusions stay partitioned as short bitcoin additionally saw critical inflows of $14.6 million last week, the report contended.

Altcoins, then again, showed little movement in spite of the effective send off of Ethereum's Shapella redesign. Ether inflows were contracted to simply $0.3 million last week. A comparable pattern was seen across Litecoin, which recorded inflows of $0.2 million. During a similar period, ADA and XRP saw inflows of $0.1 million each.

Solana and Polygon's week by week outpourings, then again, came to $2.1 million each.

In the interim, inflows for blockchain values have taken off to levels not seen after the pivotal breakdown of Sam Bankman-Seared drove FTX. The most recent information noted inflows of $5.8m last week, inferable from the new cost appreciation that figured out how to sling complete resources under administration near $2 billion - the most elevated since October 2022.

US Administrative Environment

The US organizations have expanded investigation of the resource class. The Protections and Trade Commission (SEC), as well as the Depository, have unequivocally designated decentralized finance (DeFi). Regardless of this, inflows for computerized resource speculation items were seen across most topographies. In any case, the US overwhelmed the graph with $58 million in the previous week.

Limping along is Germany with inflows of $35.4 million, trailed by Canada with $17.2 million, and Switzerland with $6.6 million.

In the interim, ProShares has arisen with the main inflow of $57.3 million. Limping along is CoinShares Physical with $11.3 million, trailed by 3iQ with $10.4 million

Comments

Post a Comment