##Hong Kong's Crypto Licensing Regime Expected to Launch Next Month

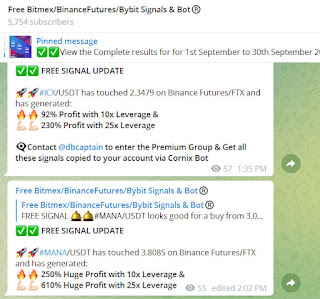

Visit – https://telegram.me/freebitmexsignals

(#40% Profit on #BTC/USDT) (#99% Profit on #BAKE/USDT) (#90%) Profit on #LINA/USDT) (#90%) Profit on #CFX/USDT) (#37%) Profit on #ALICE/USDT) (#40%) Profit on #SXP/USDT) (#40%) Profit on #COCOS/USDT) (#25%) Profit on #HOOK/USDT) (#40%) Profit on #BNX/USDT) – Our premium Bitmex, Bybit, and Binance futures auto Trade Copier cum BOT copies all signals to your account using the cornix Bot. In 2023, our crypto signals service will be the biggest on Telegram. Our Trade Copier’s superior AI and integrated approach for maximum gains have allowed it to consistently trade in the right direction over the previous few months. It stands out since the BOT copies all signals, eliminating the need for human interaction and only producing a big profit.

The authorizing system for crypto firms is supposed to send off in May, with admittance to retail brokers scheduled for June 1, per Hong Kong's money controller.

Hong Kong's profoundly expected crypto authorizing system is supposed to send off the following month.

Competing to turn into a crypto center point, Hong Kong will deliver rules for crypto trades hoping to send off there in May, per Bloomberg, refering to Hong Kong's Protections and Prospects Commission (SFC) President Julia Leung.

Speaking Thursday at an occasion, Leung said the administrative structure for crypto trades got more than 150 reactions during the public interview process.

The public meetings sent off last year looked to decide the most effective way to allow retail financial backers admittance to digital currencies, as well as analyze the chance of offering crypto trade exchanged reserves (ETFs) in the region.

The new principles are additionally expected to let retail financial backers exchange significant digital forms of money like Bitcoin (BTC) and Ethereum (ETH) on June 1.

While crypto trades are right now allowed to work in Hong Kong, financial backers with portfolios under HK$8 million, or generally $1 million, are dependent upon specific limitations under existing regulation.

The controller is likewise directing a few pilot tasks to survey the upsides of computerized resources and their applications in monetary business sectors, including the tokenization of green bonds and the improvement of Hong Kong's own national bank advanced money (CBDC)

Regardless of Hong Kong's endeavors to embrace a more loosened up approach towards digital forms of money, questions stay over the effect it might have on the business' relationship with central area China, where digital money exchanging and Bitcoin mining were first restricted in 2017.

BitMEX organizer and previous Chief Arthur Hayes additionally ringed in with regards to this issue last year, expressing that admittance to Chinese clients will be crucial for Hong Kong's allure for crypto organizations.

Hong Kong's profoundly expected crypto permitting system is supposed to send off the following month.

Competing to turn into a crypto center point, Hong Kong will deliver rules for crypto trades hoping to send off there in May, per Bloomberg, refering to Hong Kong's Protections and Fates Commission (SFC) Chief Julia Leung.

Speaking Thursday at an occasion, Leung said the administrative system for crypto trades got north of 150 reactions during the public conference process.

The public discussions sent off last year tried to decide the most ideal way to allow retail financial backers admittance to digital currencies, as well as look at the chance of offering crypto trade exchanged reserves (ETFs) in the domain.

Hong Kong's Protections and Fates Commission is set to lead a public meeting on the most proficient method to give retail financial backers admittance to computerized resources. However crypto trades are permitted to work an in the area under current principles, access is restricted to financial backers with arrangement of no less than HK$8 million ($1 million). Moreover, Hong Kong's controller said it is available to future surveys on property privileges for tokenized resources and the lawfulness of shrewd agreements, and that it is investigating various pi...

While crypto trades are right now allowed to work in Hong Kong, financial backers with portfolios under HK$8 million, or generally $1 million, are dependent upon specific limitations under existing regulation.

The controller is likewise leading a few pilot undertakings to evaluate the upsides of computerized resources and their applications in monetary business sectors, including the tokenization of green bonds and the improvement of Hong Kong's own national bank advanced cash (CBDC).

Regardless of Hong Kong's endeavors to take on a more loosened up approach towards cryptographic forms of money, questions stay over the effect it might have on the business' relationship with central area China, where digital currency exchanging and Bitcoin mining were first prohibited in 2017.

BitMEX pioneer and previous Chief Arthur Hayes likewise ringed in regarding this situation last year, expressing that admittance to Chinese clients will be fundamental for Hong Kong's enticement for crypto organizations.

Arthur Hayes Says Crypto Disappointments Are An Indication of The Framework Purifying Itself

Arthur Hayes says the speed at which ventures like Land develop and collapse is a component of the crypto business, not a bug. He established crypto trade Bitmex in 2014 and afterward turned into the first crypto awful kid. In 2021 the DOJ accused him in of disregarding the U.S. Bank Mystery Represent not carrying out an enemy of illegal tax avoidance program at Bitmex. He confess and was condemned to two years probation and a half year of home confinement. Truth be told, he was all the while wearing a lower leg arm band on a new front of New York Magazine. Presently he's living in Singapore, presenting his perspectives on the crypto business with long structure, image filled papers, regardless thinks the crypto business will save financial backers from what he calls a wrecked financial framework. "I couldn't care less on the off chance that you're entrepreneur or you're a socialist. Everyone put on a ton of obligation. We've passed where that obligation is becoming valuable," he said. "Also, in this manner everybody will take a L except if they get some crypto or some gold — some hard resource that is beyond the customary financial framework."

"Hong Kong's situation as the most significant crypto center started to tumble step by step from the get go, and afterward rapidly with the burden of its zero-Coronavirus arrangements. However, presently, it seems to be something inquisitive is occurring," he composed, adding that "the conventional affluent Chinese individuals power the Hong Kong economy."

Hong Kong's specialists have all the earmarks of being sure that their endeavors will pay off, as well.

"Hong Kong is strategically set up to be a main center point for Web3 in Asia and then some, and we join extraordinary significance to virtual resources and Web3," Secretary for Monetary Administrations and the Depository Christopher Hui said a month ago.

As per Hui, Hong Kong had gotten interest from north of 80 organizations trying to lay out a business there. These included trades, blockchain framework firms, security organizations, wallets, and installment suppliers.

Nikkei Asia additionally revealed last month that few Chinese crypto organizations, including protections organizations and banks that are keen on permitting clients to exchange Bitcoin and Ethereum on authorized trades, are looking at Hong Kong.

Digital currency trade Bitget has in the mean time reported the send off of another exchanging stage for its Hong Kong clients. As indicated by last week's proclamation, BitgetX Hong Kong plans to apply for the permit under the Hong Kong Virtual Resource Specialist organization (VASP) system.

Comments

Post a Comment