#Ripple Boosts Business Payments With Launch Of Liquidity Hub

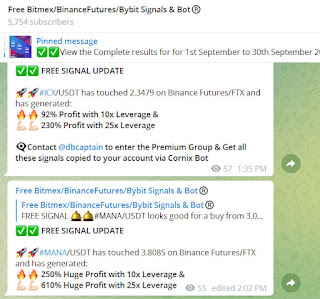

Visit – https://telegram.me/freebitmexsignals

(#65% Profit on #BCH/USDT) (#132% Profit on #ID/USDT) (#25% Profit on #LTC/USDT) (#25% Profit on #BAL/USDT) (#31% Profit on #ARPA/USDT) (#28% Profit on #KAVA//USDT) (#36% Profit on #FOOTBALL/USDT) (#32% Profit on #LINK/USDT) - ALL FREE & Paid signals share in our Telegram group went in good profit. We are Largest Crypto Signals services on Telegram in 2023 provide best high quality Bitmex, Bybit, Binance futures auto Trade Copier cum BOT which copied all signals on your account via cornix Bot. Our Trade Copier has made consistent profit in past few months has traded in the right direction as it has excellent AI & inbuilt strategy to produce maximum gains & What unique is all the signals are copied by the BOT which reduces human efforts and simply results in great profit

The firm behind XRP, Ripple Labs, has launched a business liquidity hub. The innovative solution allows business entities to access liquidity for digital assets from various crypto exchanges, market makers, and over-the-counter marketplaces worldwide.

According to Ripple, its liquidity hub will seamlessly bridge the gap between fiat systems and crypto. Ripple announced the launch on April 14 after the product’s pilot last year.

Ripple Liquidity Hub Will Integrate Diverse Solutions

The new liquidity hub aims to integrate solutions to help businesses access and manage liquidity across platforms. With it, business corporations can optimize crypto liquidity and an extensive payout network to power payments, treasury operations, and other solutions.

The product utilizes advanced technology to source the best crypto assets rates, eliminating the need for pre-funded capital positions with multiple liquidity venues. That helps businesses reduce their tied-up capital, allowing them to manage their resources efficiently.

In addition, the liquidity hub is a round-the-clock service. It allows businesses access to a vast network of payout channels globally. That makes digital assets transaction management flexible and fast while allowing the users to track their funds effectively.

According to Ripple, the success of this liquidity hub depends on its interoperability and extensive payout network across multiple asset pairs.

Finding the best rates and liquidity from diverse platforms would allow businesses to reduce their expense on high-volume transactions like crypto treasury operations.

Absence Of XRP Sparks Reaction Among Community Members

According to the announcement, the liquidity hub currently supports five cryptocurrencies, including Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Ethereum Classic (ETC), and Bitcoin Cash (BCH).

There was no mention of XRP in the announcement or the product dashboard. Also, Ripple says the liquidity hub is a standalone solution or part of its cross-border payment system.

Related Reading: Why Crypto Firms Are Struggling To Secure Banking Partnerships In The U.S.

The absence of the asset raised questions among members of the XRP community. A prominent community member, Wrathof Kahneman, pointed out the clause where Ripple said the hub is standalone. Another community member commented that XRP’s connection is less evident than he hoped.

Another prominent XPR community member, Crypto Eri, highlighted XRP’s absence in the liquidity hub. The user noted that Ripple included BTC, LTC, ETH, ETC, and BCH, without XRP.

To further clarify the controversy, Wrathof Kahneman noted that Ripple said the product does not leverage XRP. He said he had hoped the hub would have links with Ripple’s On Demand Liquidity (ODL) solution. However, the information is too ambiguous, so much so that it is hard to tell whether the liquidity hub will even leverage RippleNet.

Comments

Post a Comment