#U.S. Congress To Hold Hearing On Stablecoin Regulation, Test SEC Administrative Activity

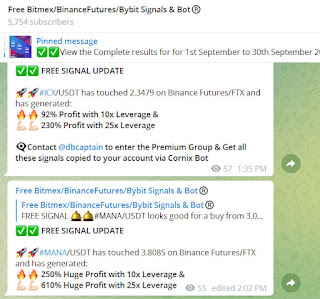

Visit – https://telegram.me/freebitmexsignals

(#39% Profit on #ADA/USDT) (#200% Profit on #ID/USDT) (#81%) Profit on #BEL/USDT) (#34%) Profit on #ETH/USDT) (#26%) Profit on #BTC/USDT) (#191%) Profit on #WOO/USDT) (#36%) Profit on #FOOTBALL/USDT) - All of the free and paid signals in We provide the highest-quality Bitmex, Bybit, and Binance futures auto Trade Copier cum BOT, which copied all signals onto your account via cornix Bot. We are the largest crypto signals service on Telegram in 2023. Our Trade Copier has traded in the right direction consistently over the past few months thanks to its excellent AI and built-in strategy for maximum gains. What makes it stand out is that all signals are copied by the BOT, reducing the need for human intervention and simply yielding a large profit.

The U.S. Congress seems to have an intriguing week ahead, as the Place of Delegates is set to discuss a draft bill which plans to direct the tasks of stablecoins inside the country.

In the mean time, the director of the Security and Trade Commission (SEC) is likewise expected to show up in Congress during a conference which plans to test and look at the exercises of the commission as of late.

New Stablecoin Bill Set For Hearing On Wednesday

On Wednesday, April 19, the U.S. Place of Delegates, the lower office of the U.S. Congress, will hold a conference on another draft charge that proposes "to give prerequisites to installment stablecoin backers, research on a computerized dollar and for different purposes."

Stablecoins are a sort of digital money whose worth is fixed to another resource, for example, a government issued money, trade exchanged item, for example gold, or another cryptographic money. These tokens are an imperative piece of the cryptographic money market as they offer financial backers a stable money related esteem. Normal instances of stablecoins incorporate USDT, USDC, BUSD, and so forth.

The 72-page draft bill scheduled for hearing on Wednesday expects to make the Central bank the administrative oversight of non-banking organizations which issue stablecoins like Tie for USDT, and so on. In the mean time, protected financial establishments that need to offer stablecoin administrations will fall under the guideline of the proper Government banking authority.

Moreover, the bill suggests that unfamiliar administrators be ordered to enroll with the fitting authority prior to delivering their administrations to the American people. Inability to enroll by a stablecoin backer will be punished $1 million and dispensed a potential five-year detainment sentence.

Also, the draft bill presents other activity necessities, which incorporate each stablecoin backer having the required specialized mastery and administration structure. True to form, stablecoin administrators will likewise be commanded to hold saves in U.S. dollars or Depository bills, which give support to the stablecoins available for use

Gensler Set To Show up Before The U.S. Congress

Elsewhere in the world, a day before the legislative discussion on the stablecoin charge, the U.S. House Board on Monetary Administrations is supposed to take up the subject of "Oversight of the Protections and Trade Commission", during which SEC Executive Gary Gensler is supposed to show up as an observer.

As indicated by the board of trustees greater part staff, the consultation will effectively inspect the administrative turns of events, strategy making and exercises of the commission since the last SEC oversight hearing that happened on October 5, 2021.

The legislative hearing on Tuesday will likewise survey a new definition change of "trade" by the commission, which ordered cryptographic money and computerized resource trades as sorts of protections trades.

As of now, the SEC director is as of now confronting inner analysis over this strategy as SEC magistrate Hester Puncture previously delivered a cursing reply.

Emphatically showing her dispute against the change of the meaning of trade, Puncture said:

"As opposed to embracing the commitment of new innovation as we have done before, here we propose to embrace stagnation, force centralization, encourage exile, and welcome eradication of new innovation. Likewise, I contradict."

Comments

Post a Comment