#Bitcoin and Ethereum Dip as PEPE Falls 9% on Fading Meme Coin Mania

Bitcoin isn't having a decent run at this moment — regardless of hitting $30,000 without precedent for a very long time in April.

Bitcoin slid on Wednesday — and took the remainder of the crypto market with it — in what has been a drowsy month for the resource.

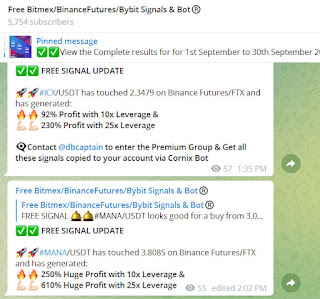

For more information on this topic visit our Telegram group

Visit – https://telegram.me/freebitmexsignals

The greatest cryptographic money by market cap was exchanging for $27,105 at 9am New York time, down 3% in 24 hours, as per CoinGecko.

At a certain point, it slid forcefully and almost dipped under the $27,000 mark. Before the end of last night it was exchanging for $27,626.

Ethereum, the second greatest computerized resource, was likewise down, exchanging for $1,868, a 2.3% drop in the previous day.

Virtually every one of the top coins and tokens shed esteem today, with Solana, Polygon, and Dogecoin all encountering critical sell-offs.

What's more, image coin madness appears to have subsided: Pepe, another token sent off toward the finish of April which experienced galactic additions, dropped by 9% in 24 hours.

Sui, a profoundly expected layer-1 blockchain which sent off last month, has likewise been hit especially hard, exchanging at a 24-hour loss of more than 6% for $0.96.

The sharp drop in costs comes as the U.S. Congress competitions to cut out an obligation limit arrangement to stay away from a default on the planet's greatest economy. Depository Secretary Janet Yellen cautioned weeks prior that it would be an "monetary calamity" were the U.S. were to default on its obligation.

What's more, a top U.S. Central bank official today expressed that there was no convincing case for the national bank to quit climbing up loan fees: a methodology which has driven financial backers to move "risk-on" resources like values and digital currency.

As it turns out, the S&P500 and Dow Jones Modern Normal lists were down on Wednesday as well.

Financial backers likewise are more centered around tech stocks, especially because of a flood in interest in the man-made brainpower area. Figuring organization Nvidia yesterday overwhelmed tech monsters Tesla and Meta as far as market cap, taking off to a market capitalization of more than $1 trillion.

Bitcoin last month contacted a 10-month high of $30,000 per coin. It has since dropped, however the resource is up significantly starting from the beginning of the year, when it was exchanging for just $16,615.

Comments

Post a Comment