#'DeFi Firewall' Aims to Make Market Safe for Institutional Traders

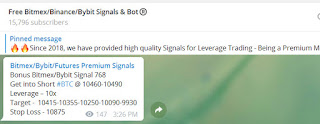

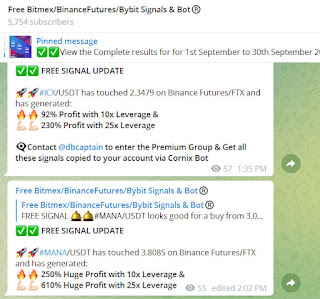

Visit - https://t.me/freebitmexsignals

For more latest news update on Cryptocurrency, Free BitMEX, Bybit signals & BitMEX Bybit Trading BOT visit above given Telegram group

Trustology, a secure crypto custody provider, has announced a DeFi Firewall to protect clients from interacting with unauthorized protocols

In brief

Trustology has released DeFi Firewall protections for their customers, preventing funds from custody clients going to unverified DeFi protocols.

Trustology secures customer funds in custodial hardware wallets, offering insurance protection and account recovery capabilities.

The new protections could draw more institutional investors and their holdings into DeFi.

A new set of security controls are making the wild world of DeFi safer for institutional crypto investors, without sacrificing the convenience and accessibility of decentralized protocols.

Trustology announced today the release of new smart contract safeguard controls, a firewall designed to only allow interactions with verified safe DeFi smart contracts from the TrustVault custody system. Trustology is a digital asset custody provider, helping institutions and other big-money entities hold their crypto in highly secure hardware modules, with added features like optional insurance coverage and account recovery capabilities.

The new controls show that innovative DeFi projects, and their touted sky high annual returns, are attracting the attention of institutional investors who recognize they need additional protections from risks that many DeFi users admittedly still only barely understand.

“DeFi” designates an emerging group of blockchain-based protocols that give users access to financial products commonly available from traditional banks and financial institutions, including dollar-denominated loans and interest-earning depository accounts. In the last four months, these products have attracted several billion dollars worth of newfound interest.

DeFi protocols are powered by smart contracts, or blocks of code that are executed automatically on the Ethereum network, cutting out trusted third-parties or middle-men that would otherwise take a cut of the earnings from a financial instrument. Smart contracts allow DeFi protocols to offer superior returns to individual users, but also introduce risks, especially when contract code has not been audited for potential bugs or backdoors used to siphon out deposited user funds.

Many DeFi protocols are also open-source, allowing anonymous developers to clone their functionality in mere hours or days while making small changes that can potentially exploit unprepared users. These copycat projects have proliferated through 2020 and rarely receive audits, further increasing the risk to users of depositing funds and never seeing them again.

Comments

Post a Comment